Page 73 - Scholarship Guide Feb 2019

P. 73

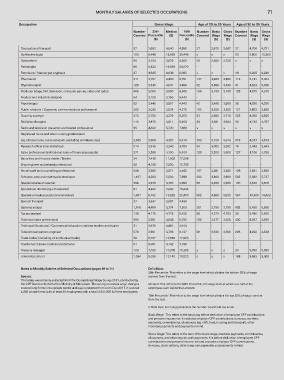

MONTHLY SALARIES OF SELECTED OCCUPATIONS 71

Occupation Gross Wage Age of 25 to 29 Years Age of 30 to 39 Years

Number 25th Median 75th Number Basic Gross Number Basic Gross

Covered Percentile ($) Percentile Covered Wage Wage Covered Wage Wage

($) ($) ($) ($) ($) ($)

Occupational therapist 97 3,603 4,040 4,959 37 3,619 3,667 37 4,706 4,731

Ophthalmologist 153 6,448 15,060 33,449 s s s 63 9,800 15,300

Optometrist 89 3,164 3,676 4,300 35 3,350 3,726 s s s

Pathologist 86 9,334 19,599 26,570 - - - - - -

Petroleum / Natural gas engineer 87 4,565 6,038 8,095 s s s 46 6,225 6,290

Pharmacist 311 3,757 4,460 5,751 137 3,820 3,890 113 5,141 5,304

Physiotherapist 129 3,515 4,031 4,956 62 3,586 3,649 41 4,523 5,029

Producer (stage, film, television, computer games, video and radio) 465 3,050 3,900 5,500 156 3,100 3,100 128 4,370 4,370

Product and industrial designer 54 3,150 3,790 5,443 - - - - - -

Psychologist 92 3,445 3,851 4,440 42 3,498 3,500 35 4,250 4,250

Public relations / Corporate communications professional 302 3,030 3,534 4,275 102 3,200 3,256 121 3,803 3,830

Quantity surveyor 473 3,700 4,372 5,200 93 3,650 3,710 222 4,450 4,500

Radiation therapist 119 3,875 4,611 5,456 36 3,561 3,594 56 4,716 4,797

Radio and television presenter and related professional 95 4,222 5,730 7,620 s s s s s s

Registered nurse and other nursing professional

(eg. clinical nurse, nurse educator, excluding enrolled nurse) 2,689 3,556 4,357 5,414 703 3,100 3,614 918 4,017 4,573

Research officer (non-statistical) 214 2,915 3,240 3,700 96 3,002 3,002 79 3,443 3,443

Sales professional (institutional sales of financial products) 371 3,266 4,100 5,400 129 3,200 3,500 127 4,100 4,750

Securities and finance dealer / Broker 34 7,419 11,002 17,208 - - - - - -

Ship engineer and related professional 62 4,160 7,200 12,700 - - - - - -

Social work and counselling professional 348 3,280 3,671 4,452 107 3,281 3,385 126 3,821 3,858

Software, web and multimedia developer 1,107 4,200 5,500 7,288 200 3,800 3,900 522 5,582 5,737

Special education teacher 358 3,270 3,750 4,650 66 3,200 3,200 100 3,618 3,619

Specialised dentist (eg orthodontist) 91 4,922 7,900 15,244 - - - - - -

Specialist medical practitioner (medical) 1,637 6,102 13,625 22,493 502 4,696 5,835 567 10,100 14,423

Speech therapist 37 3,537 3,997 4,466 - - - - - -

Systems analyst 1,616 4,486 5,774 7,500 201 3,750 3,750 682 5,420 5,500

Tax accountant 136 4,175 4,775 5,425 88 4,310 4,763 36 5,480 5,505

Technical sales professional 966 3,581 4,648 6,192 152 3,477 3,525 430 4,097 4,680

Technical/Vocational / Commercial education institute teacher and trainer 31 3,575 4,481 4,914 - - - - - -

Telecommunications engineer 576 3,981 4,706 6,137 59 3,546 3,690 226 4,222 4,528

Trade broker (including oil and bunker trader) 35 6,767 10,065 17,523 - - - - - -

Traditional chinese medicine practitioner 61 3,001 4,142 7,189 - - - - - -

Treasury manager 123 7,038 10,208 15,365 s s s 54 8,050 8,050

University lecturer 1,094 9,036 12,142 16,223 s s s 158 8,983 9,000

Notes to Monthly Salaries of Selected Occupations (pages 69 to 71) Definitions

25th Percentile: This refers to the wage level which divides the bottom 25% of wage

Source: earners from the rest.

The tables were mainly extracted from the Occupational Wage Survey 2017, conducted by

the CPF Board on behalf of the Ministry of Manpower. The survey on annual wage changes Median: This refers to the 50th Percentile, the wage level at which one half of the

covered only firms in the private sector and was conducted from Jul to Dec 2017. It covered employees earn below that amount.

4,000 private firms (with at least 25 employees) with a total of 241,000 full-time employees.

75th Percentile: This refers to the wage level which divides the top 25% of wage earners

from the rest.

s: Data have been suppressed as the number covered is too small.

Basic Wage: This refers to the basic pay before deduction of employee CPF contributions

and personal income tax. It excludes employer CPF contributions, bonuses, overtime

payments, commissions, allowances (eg. shift, food, housing and transport), other

monetary payments and payments-in-kind.

Gross Wage: This refers to the sum of the basic wage, overtime payments, commissions,

allowances, and other regular cash payments. It is before deduction of employee CPF

contributions and personal income tax and excludes employer CPF contributions,

bonuses, stock options, other lump sum payments and payments-in-kind.