Page 97 - Scholarship Guide Feb 2020

P. 97

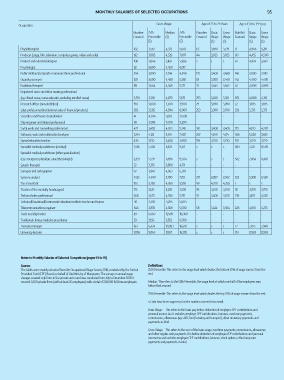

MONTHLY SALARIES OF SELECTED OCCUPATIONS 95

Occupation Gross Wage Age of 25 to 29 Years Age of 30 to 39 Years

Number 25th Median 75th Number Basic Gross Number Basic Gross

Covered Percentile ($) Percentile Covered Wage Wage Covered Wage Wage

($) ($) ($) ($) ($) ($)

Physiotherapist 182 3,567 4,333 5,678 63 3,690 3,739 71 4,946 5,281

Producer (stage, Ǡ lm, television, computer games, video and radio) 192 3,085 4,529 7,007 44 3,025 3,025 60 4,455 4,500

Product and industrial designer 108 3,846 5,160 5,986 s s s 42 4,924 5,042

Psychologist 62 3,600 4,450 6,017 - - - - - -

Public relations/Corporate communications professional 354 3,090 3,704 4,398 125 3,400 3,488 140 3,900 3,910

Quantity surveyor 329 3,600 4,400 5,360 59 3,300 3,440 142 4,400 4,405

Radiation therapist 89 3,644 4,349 5,211 31 3,643 3,643 42 4,998 4,998

Registered nurse and other nursing professional

(eg. clinical nurse, nurse educator, excluding enrolled nurse) 2,951 3,292 4,079 5,170 765 3,020 3,301 972 4,080 4,313

Research ofǠ cer (non-statistical) 198 3,000 3,300 3,900 79 3,090 3,090 72 3,695 3,695

Sales professional (institutional sales of Ǡ nancial products) 659 3,585 4,994 8,000 253 3,300 3,700 259 5,373 5,373

Securities and Ǡ nance dealer/Broker 41 4,204 7,083 17,500 - - - - - -

Ship engineer and related professional 69 4,078 7,400 9,200 - - - - - -

Social work and counselling professional 427 3,450 4,023 5,245 98 3,400 3,405 175 4,120 4,207

Software, web and multimedia developer 1,244 4,122 5,419 7,487 267 4,100 4,174 566 5,538 5,695

Special education teacher 438 3,150 3,400 3,980 159 3,250 3,250 128 3,720 3,720

Specialist medical practitioner (medical) 1,465 5,483 6,635 9,271 s s s 664 7,227 8,596

Specialist medical practitioner (other specialisation)

(eg. emergency physician, anaesthesiologist) 1,203 5,597 6,696 9,584 s s s 502 7,084 8,481

Speech therapist 52 3,376 3,800 4,771 - - - - - -

Surveyor and cartographer 97 3,941 4,963 6,281 - - - - - -

Systems analyst 1,452 4,400 5,700 7,751 217 3,897 3,942 523 5,300 5,430

Tax accountant 153 3,250 4,300 5,550 99 4,250 4,250 s s s

Teacher of the mentally handicapped 173 3,120 3,250 3,550 78 3,240 3,240 35 3,750 3,750

Technical sales professional 568 3,675 4,586 5,715 91 3,400 3,650 259 4,107 4,582

Technical/Vocational/Commercial education institute teacher and trainer 40 3,450 4,295 5,604 - - - - - -

Telecommunications engineer 646 3,878 4,569 5,600 58 3,424 3,504 228 4,061 4,273

Trade and ship broker 49 6,650 11,588 18,000 - - - - - -

Traditional chinese medicine practitioner 59 3,156 3,852 6,099 - - - - - -

Treasury manager 163 6,424 10,083 16,602 s s s 77 7,875 7,940

University lecturer 1,056 9,064 12,167 16,295 s s s 154 8,963 8,963

Notes to Monthly Salaries of Selected Occupations (pages 93 to 95)

Source: DeǠ nitions

The tables were mainly extracted from the Occupational Wage Survey 2018, conducted by the Central 25th Percentile: This refers to the wage level which divides the bottom 25% of wage earners from the

Provident Fund (CPF) Board, on behalf of the Ministry of Manpower. The survey on annual wage rest.

changes covered only Ǡ rms in the private sector and was conducted from July to December 2018. It

covered 3,000 private Ǡ rms (with at least 25 employees) with a total of 228,000 full-time employees. Median: This refers to the 50th Percentile, the wage level at which one half of the employees earn

below that amount.

75th Percentile: This refers to the wage level which divides the top 25% of wage earners from the rest.

s: Data have been suppressed as the number covered is too small.

Basic Wage: This refers to the basic pay before deduction of employee CPF contributions and

personal income tax. It excludes employer CPF contributions, bonuses, overtime payments,

commissions, allowances (eg. shift, food, housing and transport), other monetary payments and

payments-in-kind.

Gross Wage: This refers to the sum of the basic wage, overtime payments, commissions, allowances,

and other regular cash payments. It is before deduction of employee CPF contributions and personal

income tax and excludes employer CPF contributions, bonuses, stock options, other lump sum

payments and payments-in-kind.